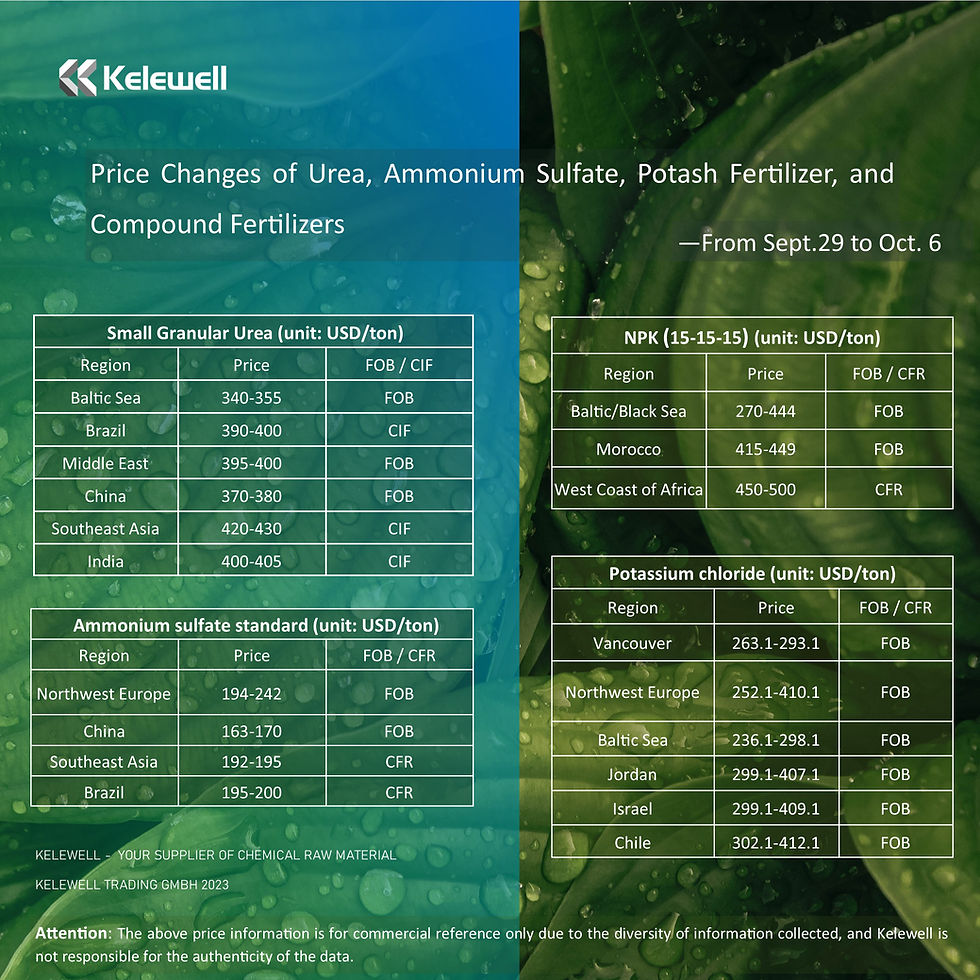

Price Changes of Urea, Ammonium Sulfate, Potash, and Compound Fertilizers from September 29th to October 6th.

Urea

International urea prices have seen a slight increase due to limited trade volumes caused by scarce import demand.

Most spot transactions this week focused on large granular urea in Egypt, Nigeria, Oman, and Indonesia. Limited trade volumes, along with an increase in prices for urea in the United States and Brazil, kept the European market stable, and transactions in Southeast Asia were slow.

The prices of ammonium sulfate, ammonium nitrate, and urea ammonium nitrate solution have not changed significantly. Trade volumes for ammonium sulfate in Europe and Brazil have slightly rebounded, but the markets for ammonium nitrate and urea ammonium nitrate solution remain subdued.

India has announced the next import tender, ending on October 20th, with the latest shipment expected by December 10th. Production is currently normal, but sales have consistently exceeded normal levels, so IPL may purchase more urea.

Export restrictions in China and Indonesia, coupled with shortened buying windows for major importers in India and Brazil, are expected to support the continued rise in urea prices.

Ammonium Sulphate

Europe: The FOB price for standard ammonium sulfate in Europe is $194-242 per ton in northwest Europe. A European producer sold 4,000 tons of standard ammonium sulfate to Spain at an offshore price of €185 per ton for shipment between October and November. Another batch of ammonium sulfate was sold to the Benelux at an offshore price of €220 per ton. Influenced by quotes and sales, the offshore price for granular ammonium sulfate in northwest Europe has risen to $283-336 per ton. Phosagro provides granular ammonium sulfate to the Netherlands and Germany at an onshore price of €300 per ton.

Turkey: Demand for ammonium sulfate in Turkey remains high. Domestic synthetic ammonium sulfate producer Bagfas offers a factory price of $223 per ton CFR for standard ammonium sulfate.

China: The offshore price for standard ammonium sulfate this week is stable at $170-175 per ton, while the price for granular ammonium sulfate is stable at FOB $190-195 per ton. An Asian-based trading company sold 10,000 tons of standard ammonium sulfate to Indonesia for loading in November.

Brazil: With new trading influences, the price of granular ammonium sulfate in Brazil has risen to $215-220 per ton. An importer purchased 10,000 tons of granular ammonium sulfate at a CFR price of $220 per ton for loading between October and November.

Indonesia: Pupuk Indonesia purchased 10,000 tons of standard ammonium sulfate from a trading company at a CFR price of $192 per ton, destined for Gresik in November. The goods will be shipped from China.

Vietnam: An importer is seeking 6,000 tons of MMA-grade ammonium sulfate for shipment to Hanoi from November to December.

Malaysia: The CFR price for ammonium sulfate is approximately $170 per ton.

Potash fertilizer

Due to weak domestic demand in China, Southeast Asia has slightly eased the tight supply of potassium chloride.

Belarus has begun exporting potassium chloride from Murmansk, Russia, and shipped 73,190 tons to ports in September.

The CFR price for granular potassium chloride in Brazil has dropped by $5 per ton. More trades are expected in Southeast Asia and Brazil in the second half of October. Concerns about logistics in Brazil may prompt buyers to make early purchases, and the lower prices in Southeast Asia may attract more buyers back into the market, helping to maintain price stability.

Compound Fertilizers

Due to increased costs, the prices of 15-15-15 compound fertilizers in Germany and Spain have risen, increasing manufacturers' net profits. Most Asian markets performed flat this week.

NFL in India received a quote for 30,000 tons of Indonesian 20-20-0+13S in a tender released last week. This was the only quote received by NFL, with a CFR price of $420 per ton. An agreement has not yet been reached.

The surge in global prices and the long holiday in China slowed down trade activities in synthetic ammonia this week, but the market remains stable.

The continued rise in raw material prices indicates the strength of the compound fertilizer market. However, the lowest-cost producers can still limit the extent of price increases to ensure market share.

Attention: The above price information is for commercial reference only due to the diversity of information collected, and Kelewell is not responsible for the authenticity of the data.

Comments