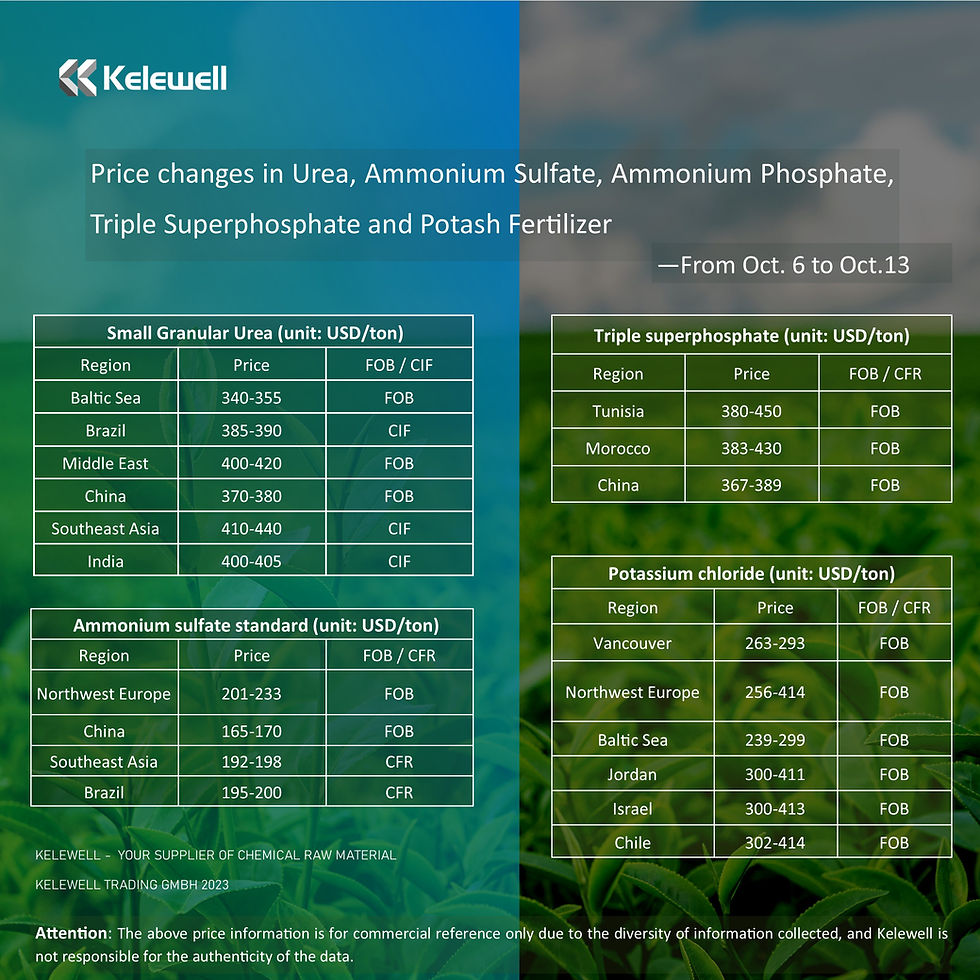

Price Changes of Urea, Ammonium Sulfate, Ammonium Phosphate, Triple Superphosphate, and Potash Fertilizer from October 6th - October 13th

Urea

Due to persistently low demand, urea prices have fallen in most markets this week.

However, some markets in Southeast Asia are relatively active due to increased buying demand and regional supply tightness. Prices in South Asia and Southeast Asia show a noticeable difference this week, with trading prices for approximately 140,000 tons of small and large urea granules ranging from CFR 405-440 USD/ton, depending on the origin. Unexpected tightness in urea supply in Southeast Asia this week supported urea prices in the Middle East, while excess supply in the West suppressed local prices.

In the U.S. market, urea prices have significantly dropped due to a lack of purchasing power.

The upcoming Indian import tender next week may be a turning point for the urea market, tightening supply and establishing new prices for November shipments.

Urea prices are declining, and buyers in most regions express reluctance to purchase goods exceeding CFR 400 USD/ton unless necessary. However, the continually rising natural gas prices and the demand for securing goods in November-December should support urea prices in the future.

Ammonium Sulphate

Northwest Europe: Standard ammonium sulphate prices have remained almost unchanged this week, with FOB prices ranging from 190-220 Euros/ton (201-233 USD/ton). A trade deal for 4,000 tons of standard caprolactam-grade ammonium sulphate was reached this week at a price of 215 Euros/ton, destined for France, to be shipped in November.

Turkey: Quotes for standard-grade ammonium sulphate from China are 195 USD/ton CFR, while quotes for granulated particles are in the range of 200-205 USD/ton.

China: The FOB price for standard ammonium sulphate is 170-175 USD/ton, and trade prices remain consistent with the pre-holiday levels. More inquiries have been received this week from Southeast Asia, India, and Turkey markets. Meanwhile, with the rise in industrial-grade ammonium sulphate prices, demand has increased for caprolactam-grade ammonium sulphate. The FOB price for MMA-grade ammonium sulphate is 145-150 USD/ton, but no transactions have been concluded. The FOB price for granulated ammonium sulphate is 190-200 USD/ton. Some granulated particle plants have raised prices to 200-205 USD/ton FOB due to increased demand from Brazil.

Sri Lanka: Ceylon Fertilizer Company has issued a tender to purchase 500 tons of caprolactam-grade ammonium sulphate, to be delivered to Colombo within 42 days from the opening of the letter of credit. The tender is expected to end on October 25th.

Brazil: Prices for granulated ammonium sulphate have increased to a range of 215-224 USD/ton CFR, while standard ammonium sulphate prices remain between 195-200 USD/ton CFR, consistent with the previous week.

United States: Starting from October 13th, AdvanSix has raised the prices of ammonium sulphate for all new orders in all regions. The FOB quote to Norco is 295 USD/ton, an increase of 25 USD/ton from the previously announced price.

Ammonium Phosphate

International ammonium phosphate market activity this week is mainly concentrated in India and Brazil, with current prices remaining stable.

Pakistan: The CFR quote for diammonium phosphate is 610 USD/ton. Private suppliers offer diammonium phosphate at 11,200-11,500 Rupees/50kg, excluding Karachi, while larger suppliers offer prices at 12,000 Rupees/50kg.

Brazil: Imports of 30,000 tons of monoammonium phosphate from Russia are scheduled for November at a price of 550 USD/ton CFR. Prices have remained stable this week.

India: The CFR price for diammonium phosphate this week is 594-595 USD/ton, with transactions totaling about 190,000 tons. According to its October 7th tender, RCF purchased 60,000 tons of diammonium phosphate from China at a price of 594.40 USD/ton CFR East Coast, to be shipped on November 15th. Meanwhile, Kribhco purchased 40,000 tons of Chinese diammonium phosphate at a price of 594.50 USD/ton CFR West Coast. Both batches will be shipped in October.

China: The latest FOB price for diammonium phosphate to India has slightly decreased this week, reaching 575-580 USD/ton. A trading company has sold 60,000 tons of diammonium phosphate to India for November. Strong demand in India may support Chinese diammonium phosphate prices in the short term. The FOB price for 11-44 granules is currently 430-460 USD/ton, higher than the end of September's 425 USD/ton. Spot supply is limited. Due to weak buying demand, producers have reduced the FOB price of TMAP from 790-810 USD/ton at the end of September to 780 USD/ton.

Thailand: Due to the expected end of the main purchasing season this month, new purchasing demand is weak. A Vietnamese NPK producer purchased 6,000 tons of diammonium phosphate for November at a price of approximately 605 USD/ton CFR.

Australia: Plans to purchase monoammonium phosphate from Morocco, Saudi Arabia, and China from November to December are underway. Due to continued weak domestic demand, buyers are adopting a wait-and-see attitude, which may persist until March next year.

Benelux: Tight supply of diammonium phosphate has led to a 23 USD increase in the high-end price to 630-655 USD/ton in the local market. The price of diammonium phosphate in Germany is 670 USD/ton, with delivery scheduled from November to March. In Rouen, France, the price of diammonium phosphate has increased by 25 Euros/ton to 610 Euros/ton. The bagged delivery price for diammonium phosphate in the UK is 535 GBP/ton, higher than the earlier price of 515 GBP/ton this month. The bagged price for diammonium phosphate in Italy is 600 Euros/ton.

Russia: A shipment of monoammonium phosphate to Brazil will continue to be loaded next month at a price of 510 USD/ton FOB Baltic. The Russian Ministry of Industry and Trade has proposed to increase the country's fertilizer export quota by 2.2 million tons, which will last until November 30th.

United States: Prices for barges scheduled for November shipment are under pressure, with the price of domestic monoammonium phosphate in Norco falling for the second consecutive week from last week's 630-645 USD/ton FOB to 600-647 USD/ton FOB. The FOB price for diammonium phosphate has risen to 530-545 USD/ton.

Egypt: The FOB price for diammonium phosphate this week is 625 USD/ton.

East Africa: Importers in Kenya and Tanzania have purchased 35,000 to 40,000 tons of diammonium phosphate from Saudi Arabian producer Ma'aden, ready for shipment in October. The CFR price may be 600-610 USD/ton.

South Africa: This week, the CFR price for monoammonium phosphate has risen again to 558-565 USD/ton. Demand continues to exist, but supply remains limited, allowing importers to increase their quotes.

Due to potential demand in South Asia, prices have been well supported, especially in the Eastern region. As major markets enter the off-season, it is currently unclear which markets will experience improved demand after December. However, it is expected that inventories will be low entering the new year, and demand in both East and West may significantly rebound in the first quarter.

Triple Superphosphate

The FOB price for Chinese TSP is 360-390 USD/ton, with quotes to Indonesia at the lower end.

Brazil's demand is weak, and TSP prices remain stable at 410-430 USD/ton CFR.

The FOB price for Egyptian TSP is 480 USD/ton.

TSP prices in Northwest Europe are rising due to strong demand, reaching around 500 Euros/ton.

Israel: Concerns have been raised at the IFA conference in Thailand this week regarding potential impacts from the conflict between Israel and Palestine. However, ICL states that its production bases or export plans have not been affected.

Potash fertilizer

This week, at the IFA conference in Thailand, concerns were expressed regarding low supply of granular potash and worries about Israeli exports following the escalation of the Israel-Palestine conflict.

Potash prices remain largely stable, while the price of sulfate of potash in East Asia has increased due to very limited stock approved for export from China.

For the remaining time in 2023, granular potash may experience higher premiums. However, by the end of the fourth quarter, more supply from Laos may alleviate some tension in Southeast Asia. Brazil may begin procurement in the coming weeks to secure more supply, and contracts may be reached in India by the end of the year.

Attention: The above price information is for commercial reference only due to the diversity of information collected, and Kelewell is not responsible for the authenticity of the data.

Yorumlar